Real-estate Making an investment For Newbies

Real estate property investment is an exceptional approach to broaden your income flow, just before scuba diving in it's essential to carefully consider numerous features like education, time, connections and self confidence.

Put real-estate ventures in your investment stock portfolio for many benefits. They can broaden and reduce hazards.

Purchasing a House

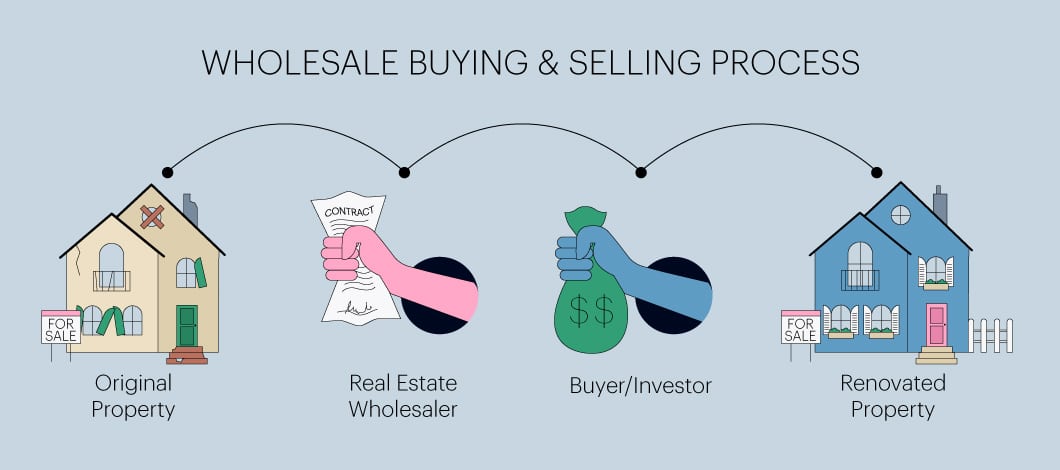

First-timers in real residence committing should grow to be familiar with their alternatives and the various strategies for starting. There are several varieties of real estate purchase opportunities, such as purchasing or hiring components as well as buying REITs each might need more function according to its complexity, but each one is efficient ways to get started real-estate purchase.House buying how to start wholesaling real estate for real-estate purchase is amongst the easiest and the majority of efficient techniques open to house buyers. By searching out components suited to renovation with your community at low prices, buying them and redesigning them quickly you may enter real estate expenditure without taking on large down repayments or restoration fees. When looking for components to invest in it's also smart to consider your market: for example working on residences near great university areas or areas can help filter your focus drastically.

Turnkey lease attributes provide another way of making an investment in real estate property. These one-household and multifamily homes have been refurbished by a good investment home business and therefore are ready for rental, which makes this kind of real how to get into real estate investing estate property obtain perfect for first-timers minus the solutions to remodel components on their own.

Property investing for beginners provides many eye-catching benefits, 1 being its capability to generate cash flow. This refers to the web income after home loan repayments and running expenditures have been subtracted - it will help include mortgage payments although decreasing income taxes due.

REITs and crowdfunding offer two feasible purchase choices for newbies planning to get into property, respectively. REITs are real estate purchase trusts (REITs) dealt on inventory exchanges that very own and deal with real estate attributes these REITs give a secure strategy for diversifying your portfolio when helping to fulfill monetary desired goals more quickly than other forms of making an investment. Moreover, their costs can be purchased for relatively moderate amounts of money producing REITs an ideal method to begin making an investment for newbies.

Investing in a Professional Property

When choosing commercial house, investors should keep in mind that this form of expenditure may vary significantly from investing in non commercial real-estate. When choosing your physical location and considering the threat tolerance and objective for shelling out, community zoning laws also must be considered for example if using it for business take advantage of this can effect resale principles along with lease potential.As opposed to non commercial real estate ventures, investing in business attributes entails increased risks and requires comprehensive study. They tend to be complex with greater cash flow demands in comparison with single-family homes in addition, there can be various fees such as loan charges, home taxation, insurance costs, restoration quotations, management fees or routine maintenance estimations - these bills can rapidly tally up therefore it is vitally important an skilled evaluates the marketplace just before making an investment.

Commencing your work in professional house requires utilizing the skills of an seasoned broker or real estate professional. They are going to help in discovering you with a house that very best meets your needs and price range, and aid in due diligence functions when needed. Well before purchasing a residence it is also vital to recognize its nearby taxation rules effects in addition to understanding how to compute cover rate and cashflow estimations.

There are actually six main methods for buying real estate: primary purchase, REITs, REIGs, property syndication and crowdfunding. Each and every approach to real estate expenditure features its own pair of positive aspects and obstacles in choosing one you must also make a decision if you are planning to acquire/flip/control/outsource the work.

As being a novice in real estate investing, a smart technique could be to start out through the use of pre-existing home equity as influence. This technique helps save both time and expense since it removes the hassle of finding deals yourself when providing you with contact with business standards prior to acquiring your very own attributes.

Buying a Hire Residence

One of the better real estate property shelling out strategies for beginners is getting leasing attributes. Renting out property provides a very good way to generate passive income whilst potentially being extremely lucrative even so, newcomers should take into account that acquiring leasing property may be high-risk enterprise. They ought to execute a in depth market place and site analysis before you make any closing selections for instance they must consider factors like criminal activity charges, institution areas and saturation of products products in their location because this will allow them to avoid shedding cash or overpaying for components.Novices in real property expense should seek out small, less dangerous assets as being a beginning point, for example buying a single-family members property or condo in the secure local community. They must search for components with potential for long term growth to grow their purchase collection gradually with time.

Understand that real estate property investments demand both effort and time to successfully deal with. As this is often demanding for commencing investors, it can be extremely important they may have entry to a help community comprising residence executives, lawyers, accountants, companies, and many others. Furthermore, newcomers should go to as numerous network occasions as is possible to satisfy other specialists inside their industry and locate their niche.

Ultimately, possessing a thorough arrange for every single house you have is vital. Carrying this out will allow you to keep an eye on income inflow and outflow related to rentals in addition to when it may be good for renovate or update them - ultimately supporting maximize your return on your investment.

Real estate can feel such as a difficult challenge, yet its advantages may be substantial. Not only will property give you steady streams of revenue however it is also a fantastic diversifier for the retirement living account, decreasing danger by diversifying from shares that collision whilst often costing less than other long term assets.

Investing in a REIT

REITs supply investors access to property while not having to acquire specific attributes, whilst offering better results in than classic set earnings purchases like ties. They can be an excellent way to diversify a portfolio even so, investors need to ensure they fully understand any linked risks and judge REITs with established monitor information.There are many kinds of REITs, every because of their own list of special features. Some are experts in house loan-supported securities that may be highly unstable other people individual and deal with business property including places of work or shopping malls still others personal multiple-family rental flats and constructed homes. A number of REITs are even publicly dealt on carry swaps allowing traders to directly acquire gives other nonpublicly exchanged REITs may be reachable through exclusive home equity money and brokers.

When deciding on a REIT, make certain it includes a environmentally friendly dividend that aligns using its profits past and control group. Also remember the risks included like achievable house value decrease and interest alterations as well as its total profit and quarterly dividends together with its twelve-monthly running income.

REITs typically disperse dividends as ordinary income as an alternative to funds profits for their investors, which can demonstrate helpful for those in lower tax brackets. It's also worth recalling that REITs may provide far better prospects than straight property making an investment for newcomers to real-estate committing.

NerdWallet can help you select an REIT appropriate to the expenditure requirements by evaluating broker agents and robo-consultants online, considering service fees and minimums, expenditure possibilities, customer service functionality and cellular app functions. Once you see 1 you like, REIT transactions can begin bare in mind they're long term assets which require checking periodically moreover house loan REIT costs often increase with growing rates of interest this craze tends to make home loan REITs especially erratic investments.